Standard Deduction 2025 Married Jointly Over 65. 65 or older and blind: Citizen or resident alien at the end of the tax year and make a joint election with your spouse to be treated as a u.s.

In total, a married couple 65 or older would have a standard deduction of $32,300. People who are 65 or older can take an additional standard deduction of $1,950 for single and head of household filers and $1,550 for.

People who are 65 or older can take an additional standard deduction of $1,950 for single and head of household filers and $1,550 for married filing jointly,.

2025 Standard Deduction Over 65 Tax Brackets Elvira Miquela, However, you would have to itemize in order to take this deduction. In total, a married couple 65 or older would have a standard deduction of $32,300.

Tax Brackets 2025 Usa Married Jointly Hedy Ralina, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). $17,640 ($24,210 if married filing jointly), don't have a qualifying child, and are at least 25 years old and under age 65;

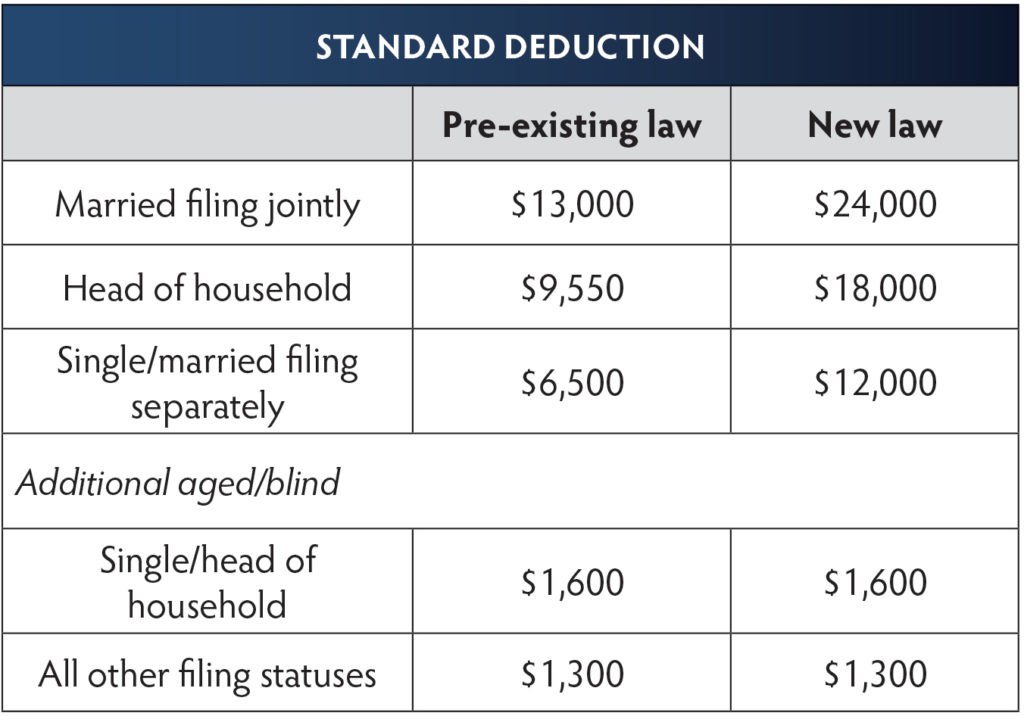

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Find out how that affects your tax bill. If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable.

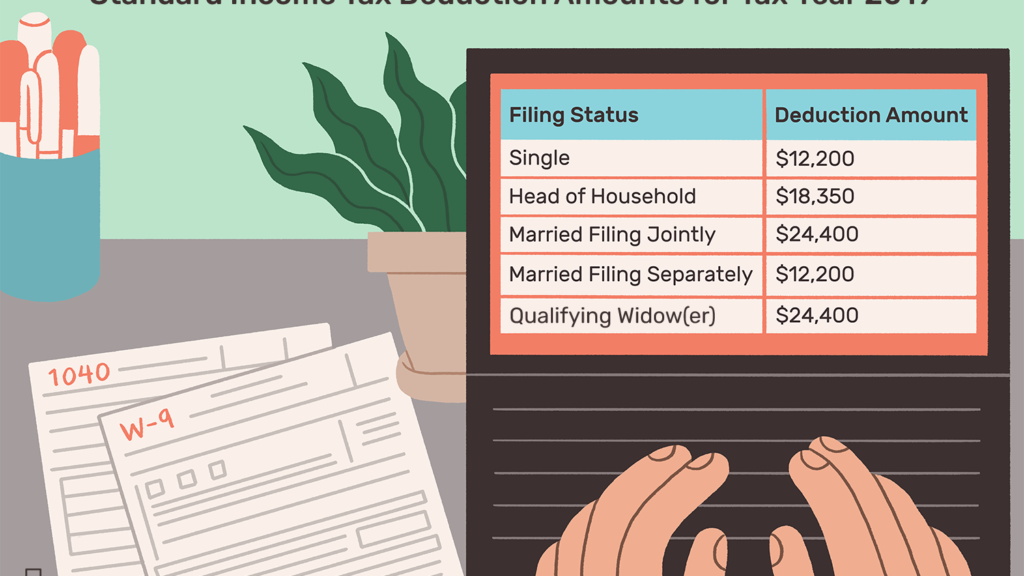

What Are The Irs Tax Tables For 2025 Married Jointly Sharl Demetris, In total, a married couple 65 or older would have a standard deduction of $32,300. The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only.

Standard Deduction 2025 Age 65 Standard Deduction 2025, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). Married filing jointly or separately;

PPT Taxes PowerPoint Presentation, free download ID1281021, Find out how that affects your tax bill. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2025. For tax year 2025, the standard deduction increased by 5%.

2025 Tax Brackets Irs Married Filing Jointly • Trend 2025, 2025 additional standard deduction amounts: $17,640 ($24,210 if married filing jointly), don't have a qualifying child, and are at least 25 years old and under age 65;

2025 Standard Deduction Over 65 Tax Brackets Elvira Miquela, Single or head of household: In total, a married couple 65 or older would have a standard deduction of $32,300.

Standard Deduction 2025 Married Filing Jointly Over 65 Standard, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only. Married filing jointly or separately;

What is the tax bracket for 2025 married belita chloris, for married couples filing jointly, if your modified adjusted gross income is $32,000 to $44,000, up to 50 percent.